Support The 6.5% Sales Tax Promise

|

Support The 6.5% Sales Tax Promise

|

|

The families of the Ocean State deserve a better policy culture, and keeping promises is a good place to start. Existing state law (General Law 44-18-18) specifies a “trigger” for a sales tax rate reduction to 6.5% (from its current level of 7.0%!) if certain internet sales tax collection criteria are met. The rationale for this law was to relieve Rhode Islanders of the additional burden of imposing a sales tax on a broader range of purchased goods, by easing the tax. Click here now to contact your lawmakers to tell them to support a 6.5% sales tax.

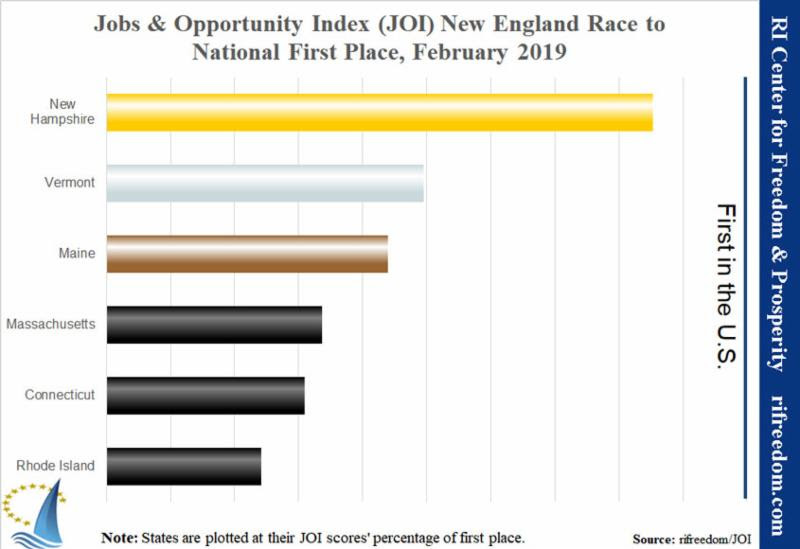

For all intents and purposes, that this trigger threshold has been met. With major retailers suffering across our state, and Rhode Island trapped at 47th place on the Jobs & Opportunity Index, it’s time for government to fulfill its half-percent promise and provide some much needed relief to the hard-working taxpayers and businesses in our state.

In many ways, the people of the Ocean State have recently suffered a wide broadening of the sales tax, but they have not yet benefitted from the promised lowered rate, as was the clear intent of the state’s law. A new internet sales tax law, signed by the Governor on Friday, takes money out of the pockets of Rhode Island families.

The General Assembly should honor its commitment to the people of Rhode Island, should abide by legislation that the legislature itself passed, and should comply with state law. Rhode Islanders want state and local government that works for everyone, not just the chosen few. Take action now, your voice is powerful. Click on the link here or on the button below to send a pre-written email to your lawmakers telling them to support a 6.5% sales tax.

|

|

In Liberty,

Mike Stenhouse, CEO

|